Mitigating the Economic Impact of COVID-19 on Black Communities Through Fintech

|

|

Fellow, Brookings Metropolitan Policy Program

|

|

|

Research Analyst, Future of the Middle Class Initiative, Brookings Institution

|

|

|

Senior Fellow, Brookings Metropolitan Policy Program

|

The COVID-19 pandemic has had a disparate impact on Americans across racial and ethnic divides, not only creating a health crisis but also an economic crisis and worsening racial wealth and income gaps. Fintech companies — companies that use innovations in the finance and technology spaces to provide alternative financial services — can help mitigate the racial wealth and income gaps exacerbated by the pandemic. Fintech can serve as a conduit for financial education and wealth creation for underserved populations historically left out of the traditional financial system.

Responding to increased COVID-19 cases in March 2020, states began to order the closure of nonessential businesses, including restaurants, bars, salons, and retail stores (Gersema, 2020). These state-ordered closures, along with voluntary social distancing, helped mitigate the spread of the pandemic but led to mass layoffs and unemployment.

Employment fell by 701,000 in March 2020, and the unemployment rate increased by 0.9 percentage points, the largest month-over-month increase since January 1975 (BLS 2020). According to a report by the Hamilton Project at Brookings Institution, “COVID-19–related job losses wiped out 113 straight months of job growth, with total nonfarm employment falling by 20.5 million jobs in April.” While the pandemic created an economic crisis across the country, it had a disparate impact on Black and Hispanic workers — particularly women.

From the start, job losses were concentrated among women, particularly Black and Hispanic women workers. In addition, workers between the ages of 16-19 and low-wage workers were also affected. Before nationwide stay-at-home orders were imposed in March, the U.S. unemployment rate stood at 4.4% — by April, it skyrocketed to 14.7%. During that same time, the rate for Black workers went from 5.2% to 16.5% for Black women and from 7% to 16% for Black men.

As businesses began to reopen and restrictions loosened, the U.S. unemployment rate began to drop, falling to 6.9% in October 2020, but the rate for Black women was 2.3 percentage points higher at 9.2%; and the rate for Black men was 4.6 percentage points higher at 11.5%. The May 2021 jobs report has confirmed what we already knew: Inequality remains in full and detrimental effect. While the U.S. unemployment rate was 5.8%, the unemployment rate for Black women workers was 8.2%, and the rate for Black men workers was 9.8%, compared to 4.8% for white women and 5.1% for white men.

According to a 2019 study by McKinsey & Company, Black Americans can expect to earn up to $1 million less than white Americans over their lifetimes. The data shows that on average Black people have higher unemployment rates, lower earnings, lower rates of homeownership, and pay more for credit and banking services. These factors contribute to vast disparities in wealth accumulation between their households and white households (Foohey and Martin, 2020). These preexisting disparities obviously left some households more vulnerable than others in the wake of the COVID-19 induced recession.

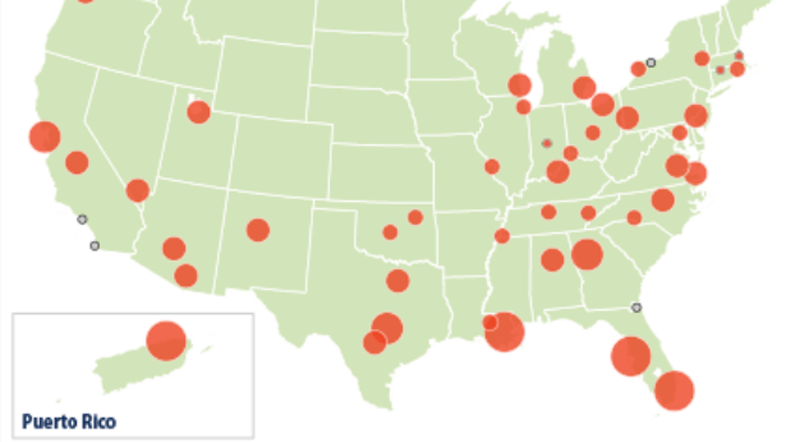

Black and Hispanic people are also more likely than white people to depend on non-traditional, high interest financial services like check cashing companies and payday lenders because there are fewer banks in Black and Hispanic neighborhoods. Increasing access to traditional banking services could save Black and Hispanic Americans up to $40,000 over their lifetime (Moise, 2019).

The percentage of Black adults who are not digitally literate (22%) is about twice the percentage of white adults (11%). Both the disparity in access to banks and low digital literacy threaten the ability of Black Americans to grow wealth in the digital economy. Fintech can help fill that access and literacy gap. Fintech companies can host, sponsor, and participate in forums and events that feature Black and Hispanic speakers and address financial topics specific to Black and Hispanic communities (Betterment, 2020). By partnering with HBCUs, minority serving institutions, Black churches, and Black sororities and fraternities, fintech companies can provide information on financial literacy, banking access, credit, housing, and other topics to fight racial economic inequality.

According to a Brookings Institution report, “Black people represent 12.7% of the U.S. population but only 4.3% of the nation’s 22.2 million business owners.” Black entrepreneurs face barriers to opening businesses with respect to access to credit. Henderson et al. (2015) examined the influence of race and gender on access to business credit lines and found that Black-owned startups received lower than expected business credit scores while white-owned startups with similar firm characteristics were treated more favorably. Through automation and sophisticated algorithms, fintech companies can provide alternative methods to assess the creditworthiness of business owners and begin to chip away at obstacles to access in banking services for underserved individuals, businesses, and communities.

Over the past 20 years, fintech companies have reimagined how to capture data, reach broader audiences, and expand access to credit (Strochak, 2017). Fintech companies can reduce costs and prices, speed up delivery, and increase convenience for underserved populations by taking advantage of automation (Saunders, 2019). The fintech industry is strategically positioned to mitigate longstanding racial wealth and income gaps by:

- Collaborations between Fintech companies and financial institutions. Financially vulnerable populations experience greater income and expense volatility. Financial technology companies can partner with banks to provide accounts that do not have overdraft fees, minimum balance requirements, and account maintenance fees to help reduce the negative impacts of this volatility (Walsh, 2020).

- Help Americans build savings to cover unexpected expenses. Many Americans, particularly low-income workers, do not have sufficient savings to cover an unexpected emergency expense – a reality that has been made worse by the COVID-19 pandemic (Konish, 2021). A study by EPI found that in 2016 half of families had no retirement savings at all and that disparities existed by race. Two-thirds (68 percent) of white non-Hispanic families had retirement savings, compared to 41 percent for Black families and 35 percent for Hispanic families.

- To increase the saving ability of Black and Hispanic families, fintech companies can offer high-yield savings accounts, automated savings features, and robo and microinvesting tools to increase savings opportunities (Walsh, 2020).

- BlackRock (an investment firm) established an Emergency Savings Initiative, making a $50 million philanthropic commitment to help their employees, customers, gig workers, and college students take steps to improve their financial health and increase their long-term financial well-being.

- Use Artificial Intelligence (AI) and Machine Learning to extend affordable credit. People generally need credit and access to other financial services to buy homes and cars, finance businesses, and send their children to college. Credit can also factor in other situations, including hiring processes for some jobs (Robinson and Yu, 2014). Credit scores can significantly impact consumers’ financial lives as lenders rely extensively on them in decision making for mortgages, auto loans, and credit cards (Consumer Financial Protection Bureau). Machine learning can help bankers make loan decisions faster and with less effort by analyzing historical loan performance data to predict loan repayment (Dryer, 2018).

- Provide low or no interest rate installment payment plans. PayPal offers the Pay in 4 plan which allows consumers to split their payments in 4 – one every two weeks. The plan offers interest free payments and does not impact the purchasers credit score.

- Support Black-owned business start-ups and innovator training programs. VentureWell’s E-Team Program supports science- and engineering-based student teams in bringing their innovative ideas to market. The program also offers trainings for teams on business model development, customer discovery, and intellectual property. Fintech companies, like PayPal should consider offering similar grants on a broader scale to support Black-owned business startups and partner with minority serving institutions to offer trainings to prepare students for entrepreneurial pathways.

Federal efforts to reduce poverty and racial inequality and the progress Black and Hispanic families have made since the passage of the Civil Rights Act of 1964 have not shielded these communities from systemic barriers to wealth accumulation due to discrimination, poverty, and a shortage of social connections (Chetty, et al., 2020). While fintech cannot close the racial wealth gap, its technologies and innovations can be exploited to explicitly promote modern era financial literacy and generational wealth building in Black and brown communities.

A Climate In Crisis

A Climate In Crisis

Executive Summary

Executive Summary